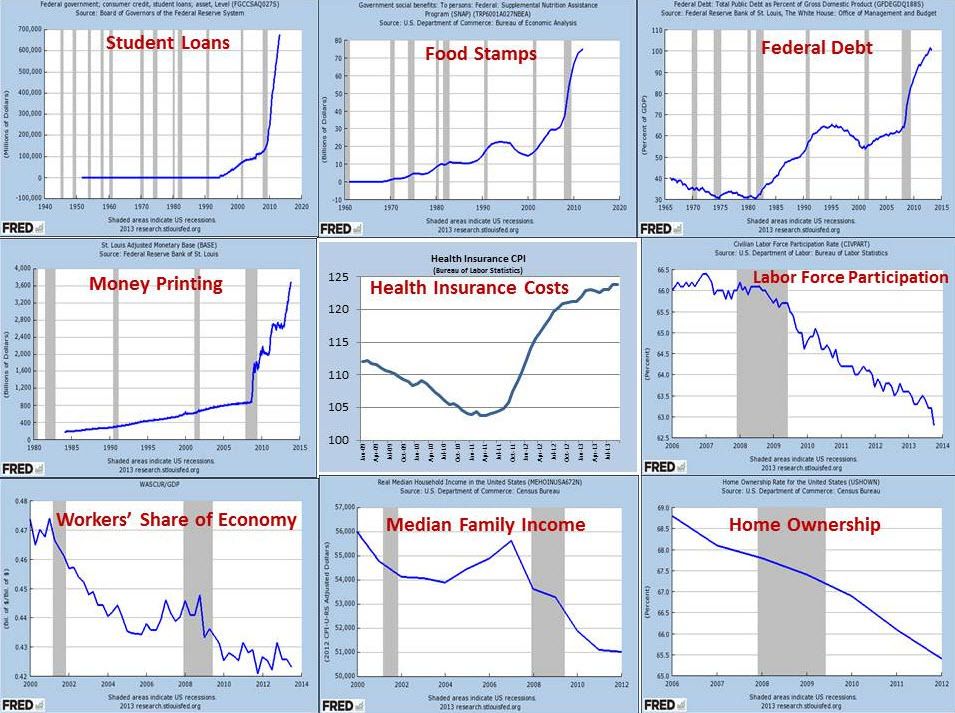

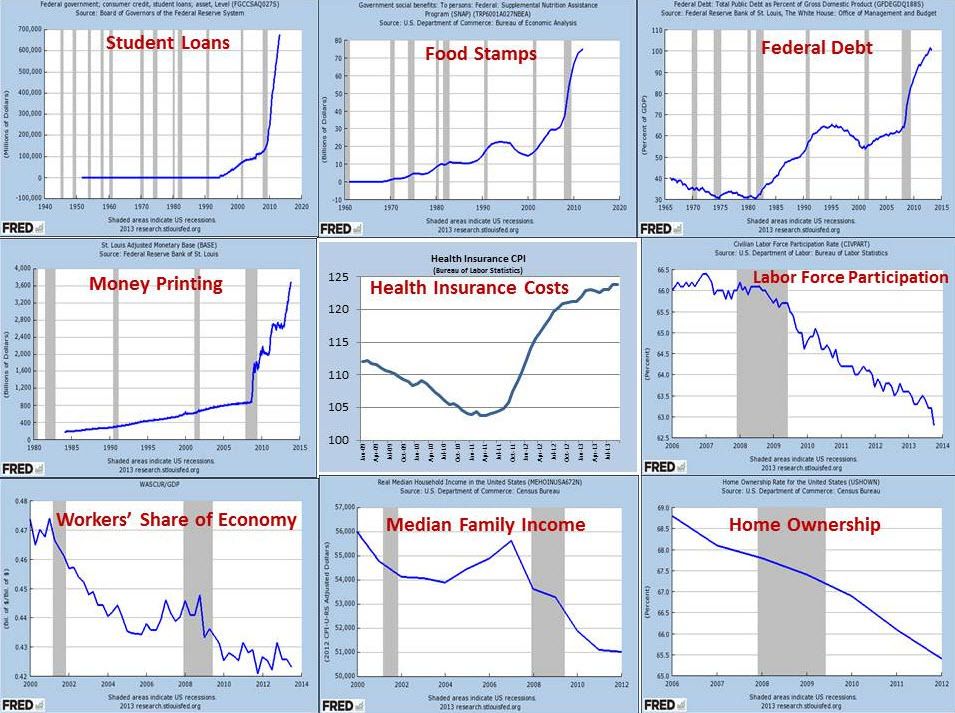

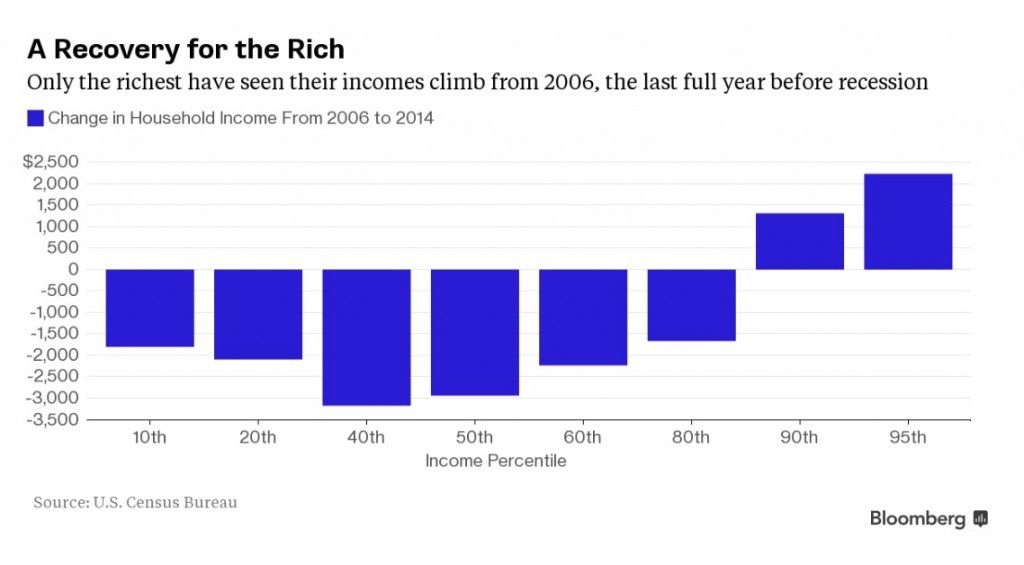

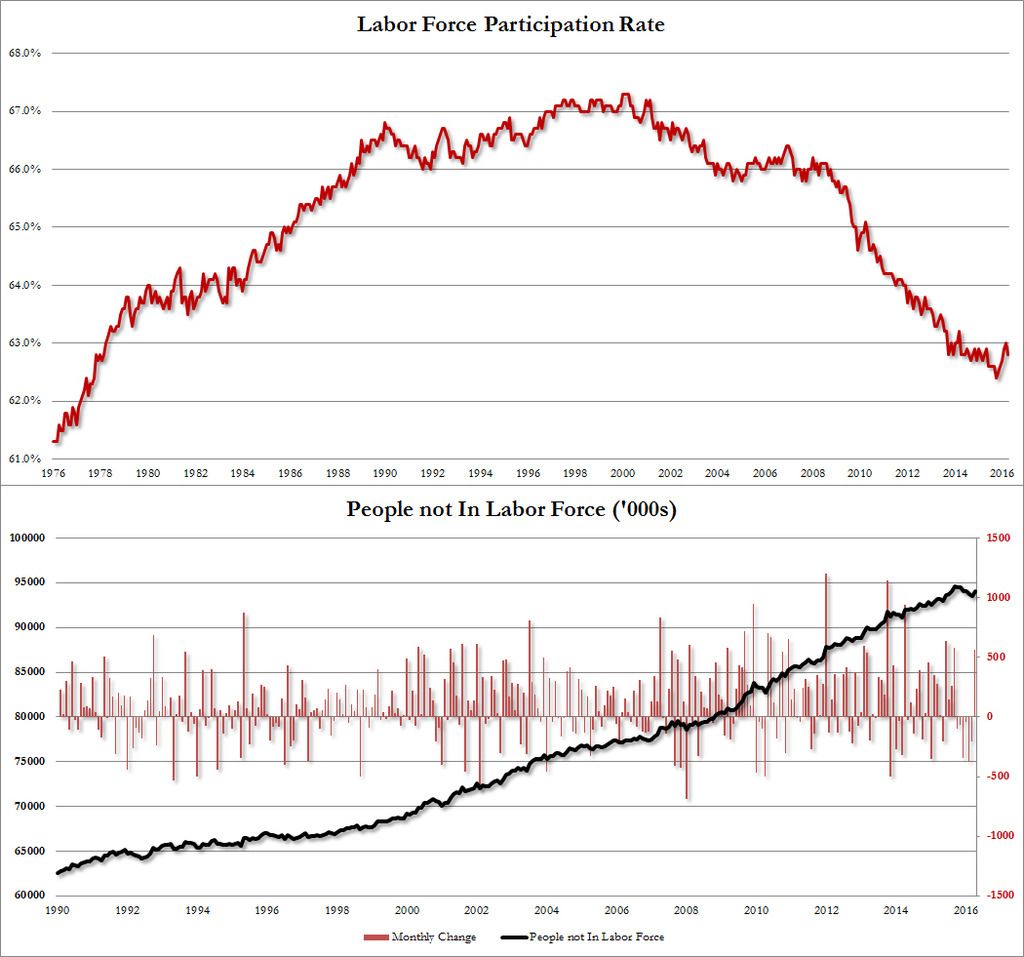

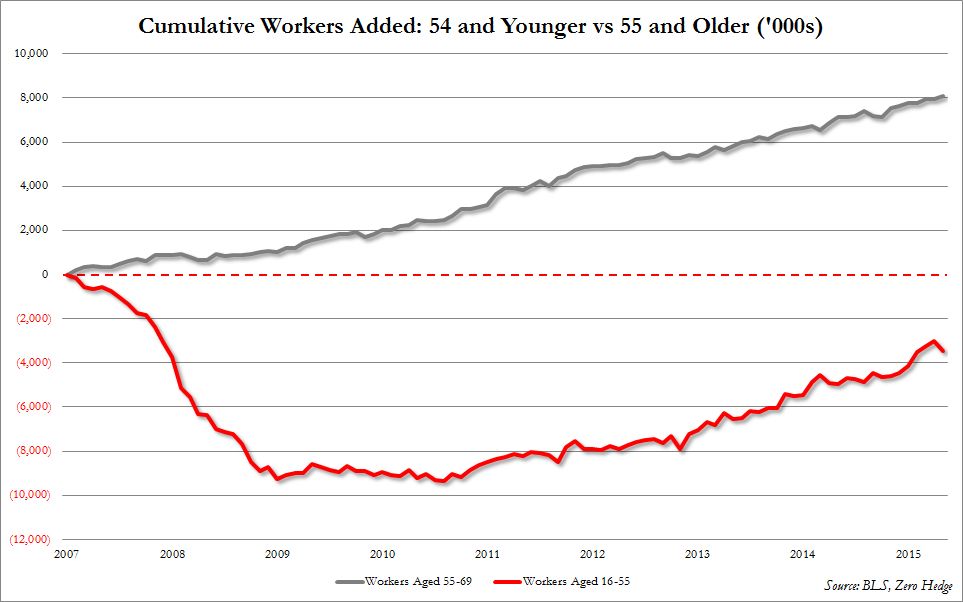

US "recovery" in a visual nutshell:

You be the judge.

You be the judge.

No matter what perspective, using the same start and end points would allow an accurate comparison of the data.

No matter what perspective, using the same start and end points would allow an accurate comparison of the data.

No matter what perspective, using the same start and end points would allow an accurate comparison of the data.

No matter what perspective, using the same start and end points would allow an accurate comparison of the data.

Shoutbox by

vBShout v6.1.0 Alpha 8 (Lite) -

vBulletin Mods & Addons

Copyright © 2024 DragonByte Technologies Ltd.

Comment